Blog

Over the last decades, governments worldwide have adopted incentive programmes that enlist consumers in tax enforcement efforts through monetary rewards. The rapid expansion of Value Added Tax (VAT) systems in developing countries and the spread of digital receipts have resulted in a surge in these policies since the early 2000s. Consumer incentive programmes aim to combat tax evasion in business-to-consumer transactions, where the VAT’s self-enforcing mechanism typically breaks down.

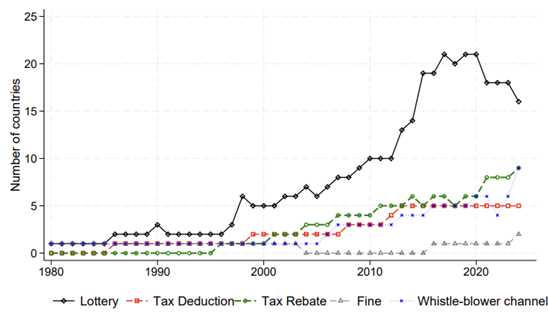

Recent research (Naritomi et al, 2025), based on data collected from more than 40 countries over the past 40 years, reviews the key features of these policies and the conditions under which they can affect tax compliance and revenue collection. Most of these policies focus on ensuring that receipts are issued through reward-driven incentives (“carrots”). Although lottery schemes are the most common, a quarter of countries use a combination of these policy tools (e.g., lotteries, tax rebates, tax deductions and whistle-blower channels) to encourage tax compliance.

Figure 1: policy design across countries.

Despite the recent surge in interest in such policies, their effectiveness in enhancing compliance hinges on preventing collusion between consumers and firms. This paper highlights two mechanisms through which consumer incentive programmes may affect firm behaviour:

The paper also emphasizes that these policies require substantial consumer participation to influence firm compliance – otherwise firms can continue reporting the same fraction of their sales. In addition, a significant level of state capacity is necessary to manage rewards for a vast number of individual consumers and to ensure that the tax authority credibly uses the information trail generated by these policies.

The key question remains whether these policies can generate tax revenue net of rewards, given that the government must provide rewards whenever consumers request receipts—including those that would have been reported regardless. Since it is impossible to determine which sales would go unreported in the absence of rewards, net tax gains will depend on the magnitude of the compliance effect and the baseline level of evasion. Little is known about the optimal policy bundle in different contexts or whether temporary consumer incentive policies can transform tax morale and lead to long-term effects.

Reference

Naritomi, Joana, Tsogsag Nyamdavaa and Stephanie Campbell. “Enlisting Consumers in Tax Enforcement: A Policy Review,” June 2025 (vol. 78, no. 2) issue of the National Tax Journal.

Published on: 31st March 2025

Print