Blog

African countries could consider temporary, progressive tax reforms that have significant revenue potential whilst minimising short-term negative economic impacts, including wealth taxes, temporary increases in the top rates of personal income tax, and higher taxation of businesses and sectors that fared well during the pandemic.

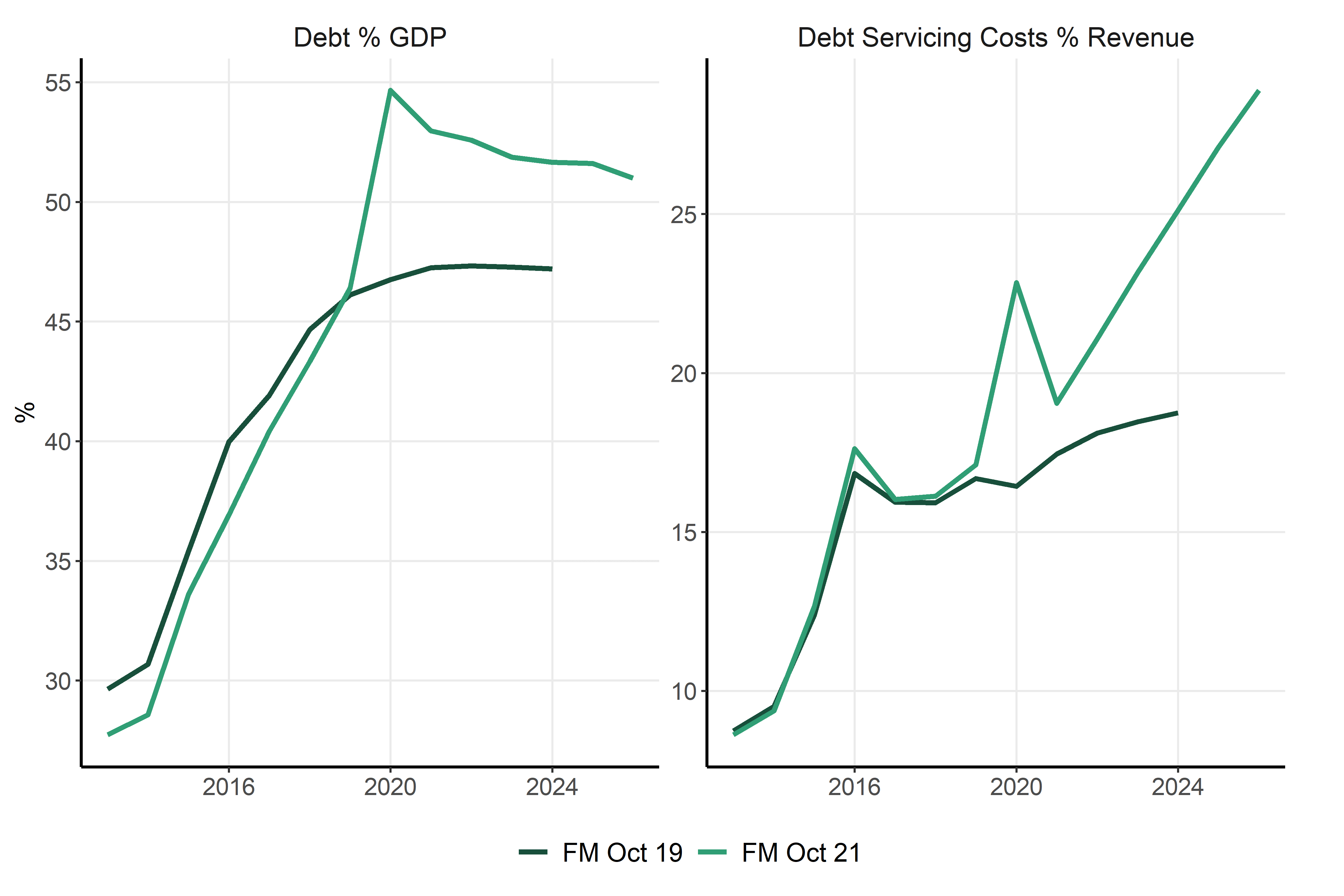

Given the massive impact of the COVID-19 pandemic on public finances globally, it is little surprise that the IMF’s October 2021 forecasts of debt and debt servicing costs in sub-Saharan Africa are substantially higher than October 2019 forecasts (Figure 1). Many countries in sub-Saharan Africa may need to consider fiscal consolidation measures to enhance the sustainability of their public finances even while they continue to manage the ongoing pandemic and seek to secure economic recovery. The need for higher public revenues presents an opportunity for countries to make their tax systems more efficient and equitable, including through well-designed green taxes, property taxes and rationalised tax expenditures. Getting these reforms right will be essential to ensure that they do not hinder the recovery and that they are socially and politically acceptable.

While our report discusses broad considerations about the scale, timing and composition of fiscal consolidation measures that apply to all countries, there are some specific policy options that may be especially well-suited for consolidation in sub-Saharan Africa. Relative to more developed countries, sub-Saharan African countries raise less tax revenue and spend less as a share of GDP. A long-standing goal of many countries in the region is to collect more in taxes. Fiscal consolidation should ideally focus on tax reforms that improve efficiency and raise more revenue rather than slashing public spending.

Countries could consider several temporary, progressive tax reforms that have significant revenue potential whilst minimising short-term negative economic impacts, including wealth taxes, temporary increases in the top rates of personal income tax, and higher taxation of businesses and sectors that fared well during the pandemic. It is important that these tax measures will only cause small distortions if they are temporary; if there is a perception that they will remain in place indefinitely, they might have larger negative effects on the economy.

Beyond temporary reforms, countries will also have an opportunity to implement longer-term revenue raising measures that can support their broader development priorities. Three policies are especially worthy of consideration: green taxes, property taxes and rationalised tax expenditures.

As we discuss in a recent report, taxes on motoring, such as fuel taxation, can raise significant revenue while reflecting the external costs of motoring, including greenhouse gas emissions, local air pollution and congestion.

Although motoring taxes exist in many countries in the region, these taxes are often not well-designed: taxes on vehicle import and purchase are higher than in developed countries, whilst taxes on fuel and ownership are lower. This does not make sense when trying to address the externalities of motoring, since they are generated by vehicle use rather than purchase. Thus, one potential avenue for African countries eyeing fiscal consolidation is to implement fuel and ownership taxes (or parking fees) that can raise revenue progressively whilst addressing the significant and growing problems arising from increasing motorisation in the region.

Whilst taxes on motoring (as well as green taxes and carbon pricing more generally) are likely to be regressive in developed countries, they are likely to be progressive in Africa. This is because car use and carbon-heavy economic activities in developed countries are more common among lower-income individuals and in lower-income areas, while car ownership and motoring in Africa, as well as work in carbon-heavy industries, are concentrated among relatively high earners.

Property tax coverage and rates are low in Africa, but such taxes have the potential to raise significant revenues. They also have several key advantages. The supply of land is not responsive to its price, so taxing land ownership would minimise distortions. Moreover, property is usually readily observable, making non-compliance harder than for many other taxes. However, some challenges need to be addressed if countries want to collect property taxes.

Property taxation is based on property valuation and in many developing countries up-to-date property registers don’t exist; bridging this gap will require significant planning and investment, as will measures to ensure compliance. One issue related to property taxes is that property is an illiquid asset, which means that households in low-income countries may run into liquidity constraints when trying to pay them. Liquidity constraints reduce the optimal tax rate because they increase the welfare costs of taxation. Governments may want to combine property taxation with offering liquidity to low-income households.

Exemptions and tax expenditures are pervasive in Africa. For example, whilst African countries are more reliant on VAT revenues than developed countries, the C-efficiency (collections relative to what would be expected if the standard rate were collected on all consumption) of VAT is very low; about one-third of potential VAT revenue is collected on average. Much of this relates to non-compliance but a large part of it is driven by exemptions. In some countries, the cost of VAT exemptions can be as high as 2% of GDP. One way to raise more tax revenue would be eliminating VAT exemptions.

Other tax expenditures, captured in the recently launched Global Tax Expenditures Database, should also be reviewed. Among them, corporate tax incentives are prevalent and costly for governments but are often not fit for purpose. They often apply to investments that are not mobile or exploit location-specific rents, such as natural resource extraction. Another problem with these incentives is that they distort economic activity and favour some firms or sectors over others without a clear rationale. They can also be regressive, their benefits accruing to higher-income individuals. All of this suggests that reconsidering tax expenditures is another possible avenue for efficiency-enhancing and revenue-raising tax reform.

Fiscal consolidation can be a difficult process but restoring the health of public finances will serve African countries in the longer term. Governments will need to be judicious about their tax policy decisions, aiming to achieve longer-term sustainability whilst minimising short-term harm. Importantly, the right policy mix depends on a number of country-specific factors, including the fiscal outlook and the existing tax system.

This blog was first published by OECD Development Matters and is reproduced here with kind permission.

Published on: 19th November 2021

Print