Project

Country: International

Fuel and vehicle taxes are a major source of tax revenue in Africa. In Ethiopia, Ghana, Rwanda and Uganda, they raised on average 1.5% of GDP (in 2019). This is a considerable sum, given the average tax-to-GDP ratio in those countries was only 13% of GDP.

Economists often view fuel and vehicle taxes primarily as environmental taxes. Yet despite the substantial revenue raised, environmental impact of vehicle use in sub-Saharan Africa remains extremely high. The region has some of the highest levels of congestion, air pollution and traffic fatalities in the world, despite low overall levels of vehicle ownership.

This raises the question – are fuel and vehicle taxes designed to address the environmental impact of vehicle use? Or are other objectives – such as raising revenue in an equitable or easy to administer manner, or industrial policy objectives, more important?

This project aims to understand the design, and the objectives that may underlie that design, of fuel and vehicle taxes in sub-Saharan Africa, drawing on previous TaxDev research.

A major contribution of this project will be to develop a comprehensive and publicly accessible database on fuel and vehicle tax policy across sub-Saharan Africa. The database will have coverage of around 40 countries, and capture tax reforms dating back to 2014.

Policymakers often want to understand how tax policy in their country compares with those in neighbouring or peer countries. TaxDev’s experience from country partnerships suggests that discovering substantial differences in tax policy is often a powerful motivator for reform. A preliminary version of this dataset has already been used to support vehicle tax reform in Ethiopia. To best support policy reform, this project will make the database accessible via an interactive online tool to make it as easy as possible for policymakers and researchers to access.

Externalities – such as congestion, air pollution and greenhouse gas emissions – are generated when a vehicle is used. A parked car does little harm. Environmental principles would suggest that motoring taxes should primarily be made up of fuel taxes, given that fuel use is correlated with vehicle use (in absence of even better targeted instruments, such as congestion charging). Vehicle purchase and ownership taxes would play only a supporting role, addressing externalities imperfectly correlated with fuel use, such as local air pollution.

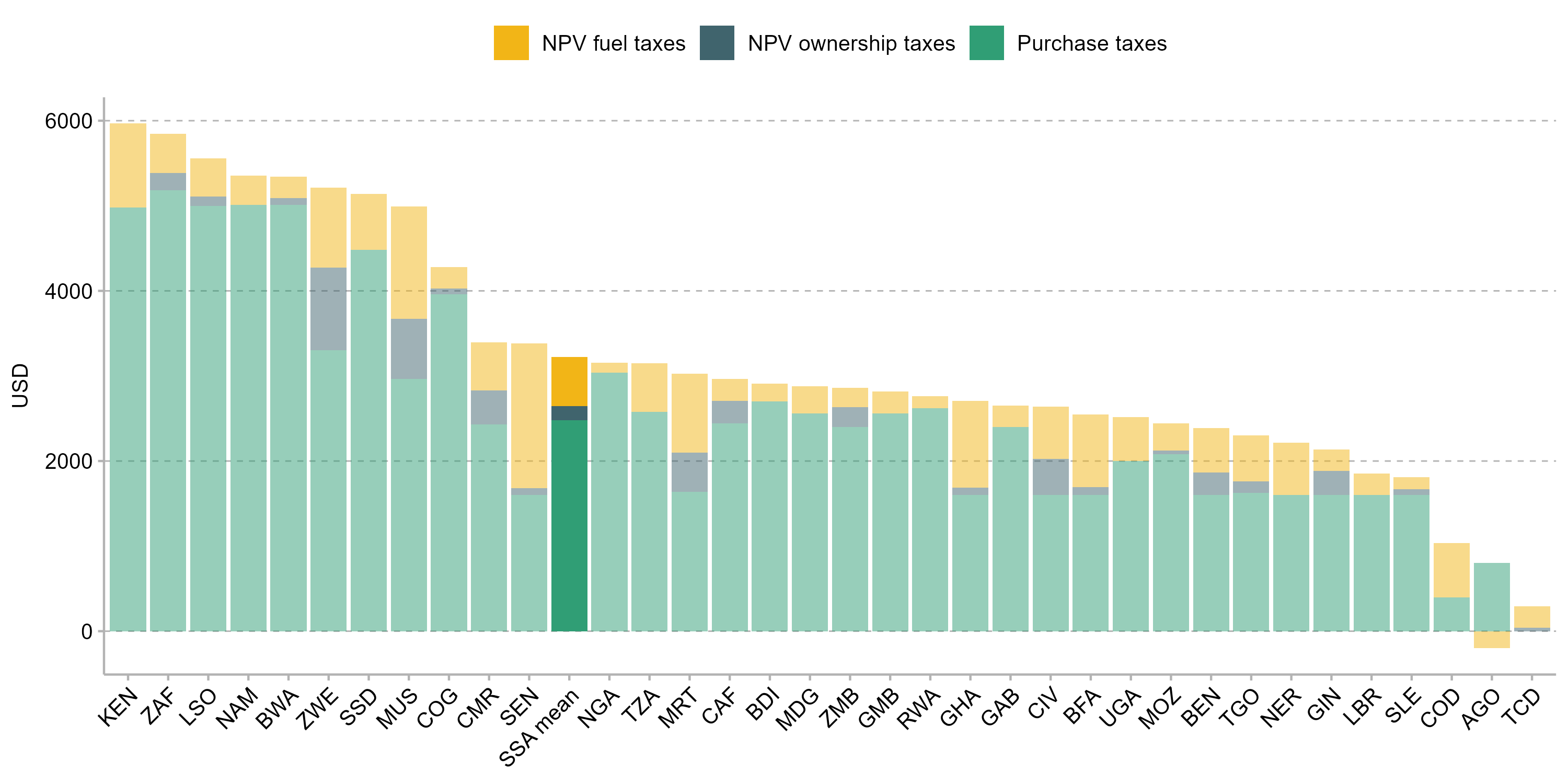

However, preliminary results show that opposite is true in most countries. The graph below shows the lifetime vehicle tax across sub-Saharan African countries. The lifetime vehicle tax is defined as the vehicle purchase tax, plus the net present value of fuel taxes and vehicle ownership taxes. The graph assumes the vehicle is a 2019 Toyota Yaris with a pre-tax price of USD 8,000, driven 10,000 km per year for ten years, with future taxes discounted at 5%.

Figure 1. Lifetime vehicle tax across sub-Saharan African countries.

In most SSA countries, up-front purchase taxes make up a significant share of total taxes paid over the lifetime of the vehicle. Under these assumptions, the average lifetime tax in SSA on a vehicle worth $8,000 at import is $3,325.The majority of this is made up of vehicle purchase taxes ($2,482), with the remainder being the net present value of fuel taxes ($577) and the net present value of ownership taxes ($165).

In addition, vehicle purchase taxes themselves do little to encourage a greener vehicle fleet. As taxes are typically ad-valorem, an expensive but cleaner vehicle would be taxed more than a cheaper but dirtier vehicle. Using data scraped from vehicle sales websites on typical models sold in Africa and their prices, there is little correlation between a vehicle’s environmental credentials and the purchase tax it pays.

These results show that motoring taxes in sub-Saharan Africa are not particularly consistent with environmental objectives. Motoring tax design is more consistent with the objective of raising revenue equitably, given that vehicle purchases are generally highly concentrated among the rich in sub-Saharan Africa.

Published on: 30th October 2025