Blog

Lockdown led to a severe demand shock for firms, especially in the hospitality, transport and retail sectors. Analysis of administrative tax data suggests that half of formal firms may become unprofitable, exit rates double and tax revenues from firms fall by over 1.5% of GDP.

The Covid-19 pandemic is generating a vast shock to both the supply and demand for goods and services (Macaulay and Surico, 2020). The impact of the demand shock can be simulated using administrative tax data for formal (tax-registered) firms. Simulations for ten low- and middle-income countries suggest that, in the absence of government support:

As a result, tax revenue remitted by the corporate sector is expected to fall by at least 1.5% of pre-crisis GDP, and aggregate corporate losses will increase substantially. Differences in sectoral composition and in firms' cost structures can generate different-sized effects across countries.

Policy responses to protect employment need to be adapted to the country context: wage subsidies are expected to be less effective in developing countries compared with higher-income countries.

The Covid-19 crisis affects firms through multiple channels. This is true in both developing and developed countries.

First, lockdown and movement restrictions triggered a fall in demand (Coibion et al, 2020). This demand shock was particularly severe for the hospitality sector, non-essential retail and transport.

Second, the containment measures lead to supply shocks. For example, some employees are unable to work during lockdown, and certain inputs are difficult to purchase. Some imported inputs are more expensive or arrive with delay. Supply shocks can cause further demand shortages (Guerrieri et al, 2020).

Third, some firms suffer financial shocks. This is especially the case for firms with high debt levels, which find it difficult to increase borrowing, and firms in emerging markets with US dollar-denominated debt.

Fourth, the high level of uncertainty deters investment (World Bank, 2020). Besides, firms are linked with each other through trade, so that shocks travel and amplify through supply chains (Baqaee and Farhi, 2020; Bonadio et al, 2020).

While a comprehensive quantification of all the shocks that firms face is complicated, the demand shock component can be analysed with available data and a set of simple assumptions.

What data are needed?

Quantifying the impact of Covid-19 on firms requires firm-level data, but the availability of firm censuses or survey data is limited in many developing countries. The World Bank is conducting quick firm surveys in countries around the world to assess the damage to firms. The first published results are now available for Ghana; results for other countries are expected to be released in the next few weeks.

These surveys include both formal and informal firms. When focusing on formal firms only, one can use administrative records to simulate the impact of Covid-19. A recent study does this for ten countries at different income levels in sub-Saharan Africa, Eastern Europe and Latin America (Bachas et al, 2020).

Administrative tax data contain the entire formal sector for a country. One can extract measures of firms’ revenues, costs and profits, and the breakdown of costs into material inputs (for example, inventory and raw materials), labour costs and fixed costs (for example, machines and buildings).

What assumptions are needed?

Simulating the impact of Covid-19 requires a few assumptions about the shock that firms face and the adjustments that they make. Bachas et al (2020) categorise firms into three impact groups based on their sector, following the taxonomy by Vavra (2020).

Firms in the high/medium/low impact group are assumed to face a drop in demand (sales) of 100%, 50% and 20% respectively during lockdown. In the simulations, the shock lasts either three or five months. These scenarios provide plausible proxies for the lockdown period; in practice, lockdowns differed in their duration, enforcement and severity (Hale et al, 2020), and are thus hard to quantify precisely.

Firms are assumed to produce output using capital, labour and material inputs in fixed proportions – with the proportions estimated from each firm's tax declaration. Firms can reduce their material costs proportionally to the drop in demand; they reduce labour costs only when making losses, because hiring new workers is costly; and they cannot adjust their fixed costs.

Furloughing workers is not possible in this world, but the impact of wage subsidies is discussed further below. The implicit assumption is that firms aim to weather the shock in a way that allows them to scale their production back up quickly at the end of lockdown. In practice, some of the loss in demand might be permanent. Firms expect demand to be a third lower than pre-Covid-19 levels on re-opening (Balla-Elliott et al, 2020).

While simplistic, these transparent assumptions allow the estimation of plausible lower bounds for the impact of lockdown on formal firms’ profits, employment and tax payments. The following sections summarise the estimates presented in Bachas et al (2020), comparing to related work where available.

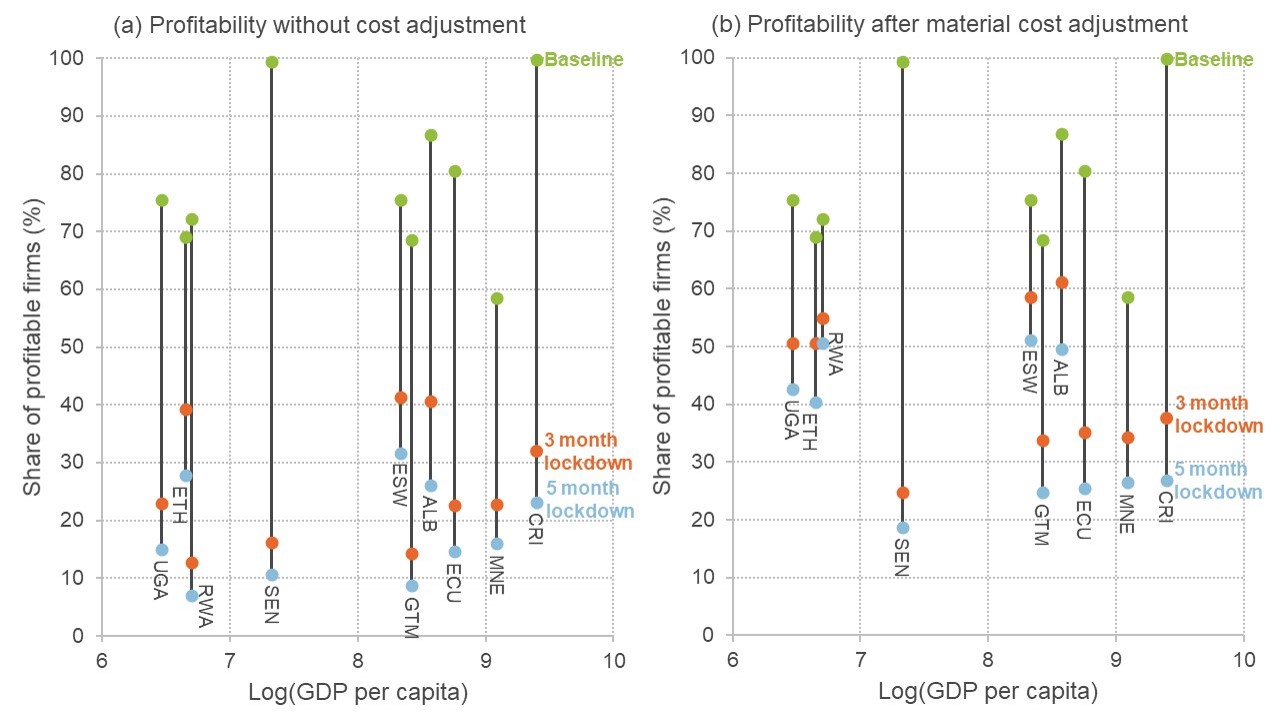

The average formal firm reports an annual profit margin of 10%. In a scenario in which firms receive a lockdown-triggered demand shock for three months and do not adjust their costs, only 27% of firms remain profitable. This is shown in Figure 1a, where countries are ordered by GDP per capita.

In a scenario in which firms can adjust material inputs, 44% remain profitable (see Figure 1b). The largest firms tend to fare a bit better, as they operate in less affected sectors and have a lower share of (non-adjustable) fixed costs. This mitigates the aggregate profit loss slightly.

Firms that are unprofitable after adjusting their material costs will be likely to reduce their labour costs by laying off employees. It is reasonable to assume that firms cut their payroll only when it is necessary to avoid making losses.

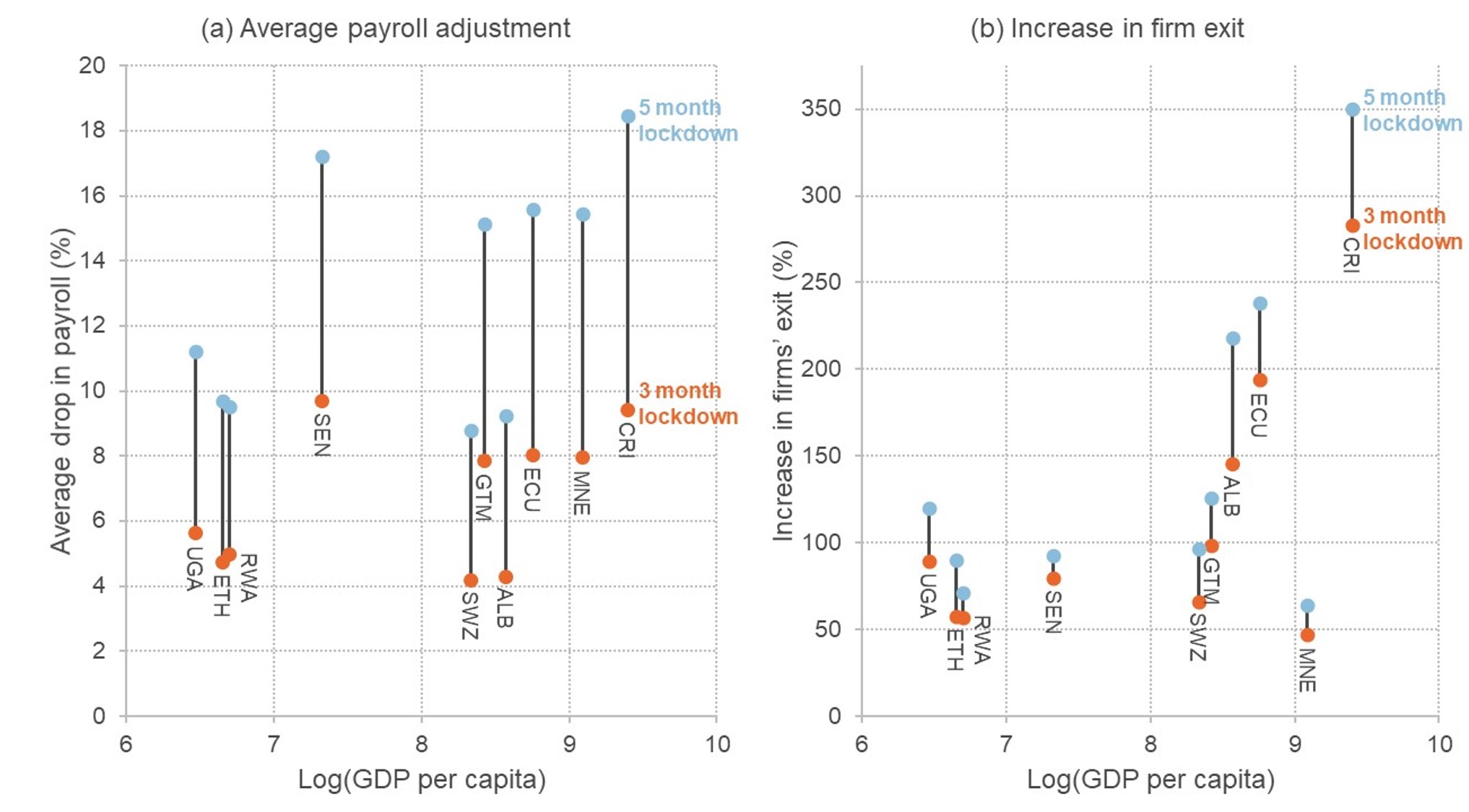

Firms that can absorb the demand shock without becoming unprofitable do not lay off workers. Under these assumptions, the average firm is predicted to cut its annual payroll by 6.7% (see Figure 2a). In aggregate, 5.8% of the annual payroll (23.2% of the lockdown quarter payroll) are expected to be lost.

The panel dimension of administrative tax data can be used to predict exit rates (business closures). The pre-Covid-19 data provide estimates for average exit rates among loss-making and profit-making firms. The exit rates for these two groups are remarkably stable across countries.

One can obtain post-lockdown exit rates by applying the exit rates among loss-making and profit-making firms to the post-lockdown distribution of firm profits (as discussed above). The results suggest that the share of firms exiting would double on average, with large variation across countries (see Figure 2b).

Firms in poorer countries might fare better than predicted, as they could join the informal sector instead of shutting down completely, and because their true profitability might be higher than observed in the data due to misreporting.

Unless mentioned, these results are averages across ten countries: Albania, Costa Rica, Ecuador, Eswatini, Ethiopia, Guatemala, Montenegro, Rwanda, Senegal and Uganda.

Wage subsidies are a widely discussed policy tool (Giupponi and Landais, 2020). Several studies show that wage subsidies can protect employment in a recession. These studies evaluate wage subsidy schemes in Italy (Giupponi and Landais, 2020), Switzerland (Kopp and Siegenthaler, 2019), France (Cahuc et al, 2018) and Germany (Boeri and Bruecker, 2011).

Wage subsidies triggered during recessions are less common in developing countries. Several studies have evaluated wage subsidies and other active labour market policies intended to facilitate labour market entry (for a survey, see McKenzie, 2017), and to reduce youth unemployment specifically (Alfonsi et al, 2020).

To our knowledge, there is only one study of a wage subsidy implemented by a developing country in a recession (Bruhn, 2016). That study suggests that industries in Mexico eligible for a wage subsidy during the financial crisis exhibited slightly (though not statistically significantly) higher employment and faster employment growth after the crisis.

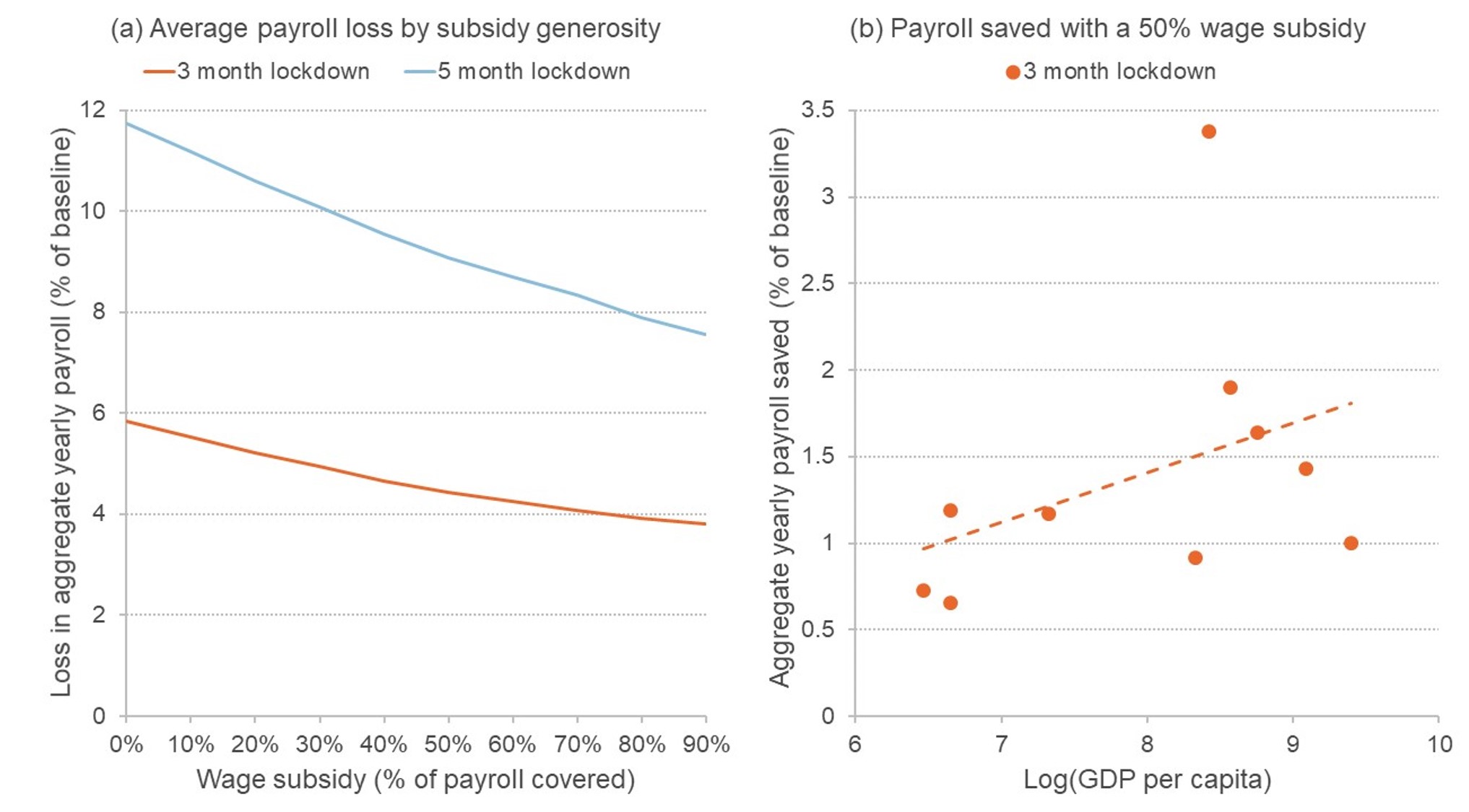

Based on simulations using the administrative tax data, Bachas et al (2020) suggest that wage subsidies can protect some share of employment, but are less effective in lower-income countries with high labour informality: a 90% wage subsidy is expected to reduce predicted payroll cuts by only 30% (see Figure 3a).

This is because wage subsidies affect employment only in ‘marginal’ firms – that is, firms that lay off workers in the absence of the wage subsidy but retain them when receiving the subsidy. Firms are marginal if their losses can be compensated by a reduction in their labour costs.

But formal labour costs only represent 21% of all costs on average, and an even smaller share in poorer countries, where informal employment is more common (Ulyssea, 2018). For many firms in low-income countries, fixed costs are so high that the revenue shock pushes them into loss-making territory even if wages are subsidised. As a result, wage subsidies are more useful in higher-income countries (see Figure 3b).

Since lockdown affects firm profits, it also affects tax payments. What is the reduction in tax revenue for the three main taxes remitted by firms: corporate income tax, payroll tax and value-added tax (VAT)?

The results suggest that tax revenue from firms would drop by at least 1.5% of GDP in 2020 after a three-month lockdown, and by 2.5% of GDP after a five-month lockdown. These estimates constitute a lower bound, as they do not account for expected losses in other taxes such as import tariffs.

In addition, firms are predicted to accumulate excess losses equal to at least 2.9% of GDP. Governments thus need to provide additional loans and credit guarantees for firms to avoid bankruptcies.

The estimates imply very large increases in borrowing needs to cover tax revenue shortfalls and to guarantee loans to the corporate sector. This creates additional challenges for developing countries with limited fiscal space (Loayza and Pennings, 2020; Benmelech and Tzur-Ilan, 2020). Countries with limited access to international capital markets will require a substantial increase in budget support from donors.

The simulations discussed here face several limitations:

Taking account of the first two caveats, the estimates could be considered as plausible lower bounds arising from direct effects of lockdown, without considering the network structure of the economy and the ways in which different shocks amplify each other.

Two other challenges are related to the data used in the analysis. First, profits in administrative tax data could be under-reported for tax minimisation purposes, meaning firms might exhibit artificially low profitability in the pre-Covid-19 baseline.

Second, the data cover only registered firms, and not the informal sector. Yet it can be argued that formal firms are the relevant group to study from a public finance perspective, as they remit the lion’s share of taxes and because they can be reached directly with tax policy measures and liquidity provision.

The simulations discussed here can be improved in the coming months with the release of monthly and quarterly data (notably on VAT payments). This would allow refining the calibration of sector-specific demand shocks based on realised shocks. After corporate income tax declarations for 2020 are filed, it will also be possible to compare predicted effects on firm profits and tax payments to actual outcomes.

Over the medium term, the data would also show evidence of shifts in the firm-size distribution and the concentration of market power. The demand shock simulations suggest that small and young firms (with high fixed costs) are more likely to disappear and larger firms may increase their market share.

In addition to firm-level tax records, some countries generate transaction-level records from e-billing systems and credit/debit card reporting systems. These data are increasingly available in developing countries. They can be used for ‘nowcasting’ of economic activity, and for gaining a very granular understanding of economic dynamics at the local and sectoral level (for example, see Chetty et al, 2020, for the United States).

Replication codes are available here and will continue to be updated with extensions based on feedback from governments and researchers.

Country-specific World Bank Practice Notes that summarise the results for individual countries are published here for Albania, Costa Rica, Ecuador, Ethiopia, Guatemala, Montenegro, Senegal and Uganda.

The World Bank pulse surveys are conducted by a team lead by Denis Medvedev.

Published on: 9th September 2020

Print