Project

Country: Pakistan

Audits and Tax Compliance

Modern tax systems are based on the principle of self-assessment where the tax audit is usually the sole contact between the taxpayer and the tax authority and thus the only instrument through which the government can detect noncompliance and can create deterrence against it. This project aims to examine how effective audits are in achieving these two goals. We find that (1) audits detect large amounts of tax evasion, but (2) they do not create any deterrence against tax evasion.

VAT Audits in Pakistan

We exploit the universe of VAT audits in Pakistan for the period 2013—2017. The key advantage of the Pakistani context is that in three out of these five years, audit was assigned on the basis of a random computer ballot. Later, when the mode of assignment was reversed back to risk-based, the risk criteria were publicly disclosed. In the final two years, audits were assigned based on these risk criteria but given that firms that satisfied the risk criteria were more likely to be audited, auditees from the pool of risky firms were again selected using a random computer ballot. The policy creates three interesting pieces of variation that we exploit in our empirical analysis. Random assignment in the first three years is akin to a Randomized Controlled Trial done at scale (at the national level) and repeated in three consecutive years. The public disclosure of risk criteria creates another experiment whereby firms learn their risk of facing a tax audit in the coming year. Finally, quasi-random allocation within risky firms create interesting variation within firms facing a heightened risk of audit. We exploit these three sources of variation in our empirical framework.

Tax Audits Do Not Deter Tax Evasion

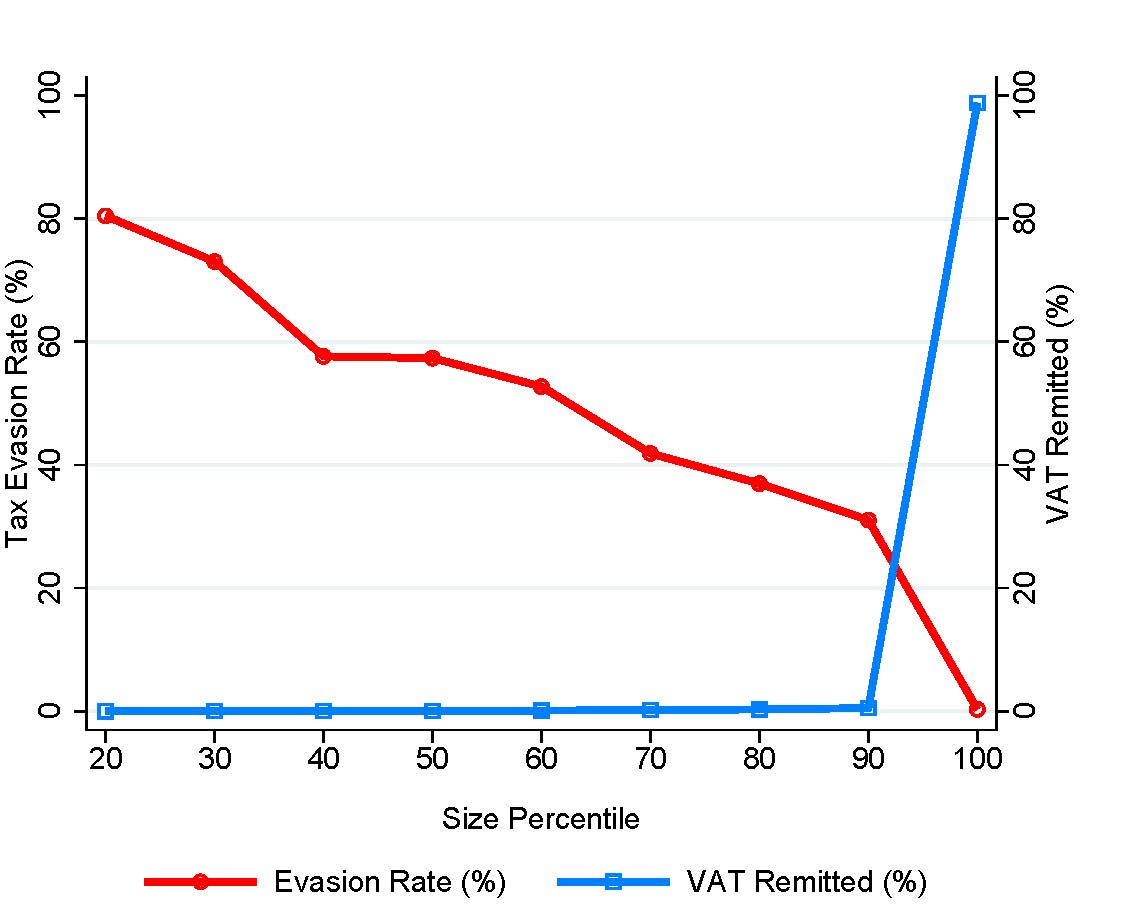

We document two interesting results. First, VAT audits in Pakistan detect large amounts of unpaid VAT by firms. Figure 1 shows that the detected amount - measured by the amount detected in audit as a % of the firm's corrected VAT liability - decreases with firm size with smaller firms evading far more than larger firms.

Second, despite detecting large unpaid liabilities, audits do not deter tax evasion in future years. Figure 2 shows that the firms do not report significantly more sales following the audit.

This creates a detection without deterrence puzzle. Our preferred explanation of this puzzle argues that the lack of deterrence reflect weak post-audit enforcement. In the standard model of tax compliance, recovery of the detected amount is taken for granted but in practice developing countries may lack the capacity to enforce detected amounts and penalties, conditions under which audit would not establish credible deterrence against tax evasion.

Published on: 25th March 2022