Blog

This blog examines the implications of tax target setting in low-income countries.

This blog was originally published on odi.org on 3 June 2024 here, and is reproduced with kind permission.

The IMF recently unveiled their Global Public Finance Partnership, which reiterated results of a 2023 IMF study, Building Tax Capacity, suggesting that in low income developing countries (LIDCs), a ‘9 percentage-point increase in the tax-to-GDP ratio is feasible’.

However, such estimates of tax potential are not a good basis for setting expectations of how much tax a country could raise. Observed trends in tax-to-GDP ratios of low income countries in the last two decades suggest these IMF estimates are unrealistic, at least in the short- to medium-term. They are also of limited policy use as they do not point to the exact tax policy or administration challenges that need addressing.

The reality of slow growth or stagnating tax revenues in many LIDCs, at a time when spending pressures are rising, highlights the importance of seeking improvements in tax policy and administration. But there must also be realism about the size of the increases we can expect from context-specific reforms, and there must be equal emphasis on also increasing international financing support from increasing concessional finance and debt relief.

The IMF’s estimates of tax potential suggest that, given their underlying economic structure and institutions, LIDCs could raise additional tax revenue of up to 6.7% of GDP through reforms to the design of taxes and revenue administration, and a further 2.3% of GDP from institutional reforms that would see them reach similar levels of institutional performance to emerging market economies. This is a dramatic increase compared to the current average tax-to-GDP ratio in LIDCs of 13.2%.

The exercise to estimate tax effort calculates how far away a country’s current tax collection is from a hypothetical ‘frontier’ or estimated maximum ‘tax potential’, controlling for factors such as GDP per capita, the size of the agriculture sector, government effectiveness and corruption perceptions. ‘Tax potential’ is then simply the ratio of the actual tax-to-GDP ratio to this estimate of tax effort.

A number of stylised facts have emerged from this literature, most notably that the size (i.e., level of per capita GDP) and structure (i.e., relative sizes of the agricultural, manufacturing or extractives sector) of an economy are highly correlated with observed tax-to-GDP ratios. These factors can be thought of as determinants of the size of a country’s tax base, the economic activity on which taxes could theoretically be collected. However, to efficiently collect taxes from a given base, strong tax capacity (broadly defined by the tax policy environment and institutional arrangements for tax administration) is also essential.

Tax effort models, unfortunately, do a pretty poor job of accounting for the level of tax capacity across countries, mainly because we do not have good cross-country data on tax policy structures or features of the tax administration (although the TaxDev Employment Income Taxes Dataset, for example, attempts to fill this gap). There are also debates around appropriate methodologies for making these estimates. This means that while tax effort models might produce results that make for punchy headlines, they run the risk of misleading readers to believe that there is a magic formula for dramatically increasing tax collections in the short term.

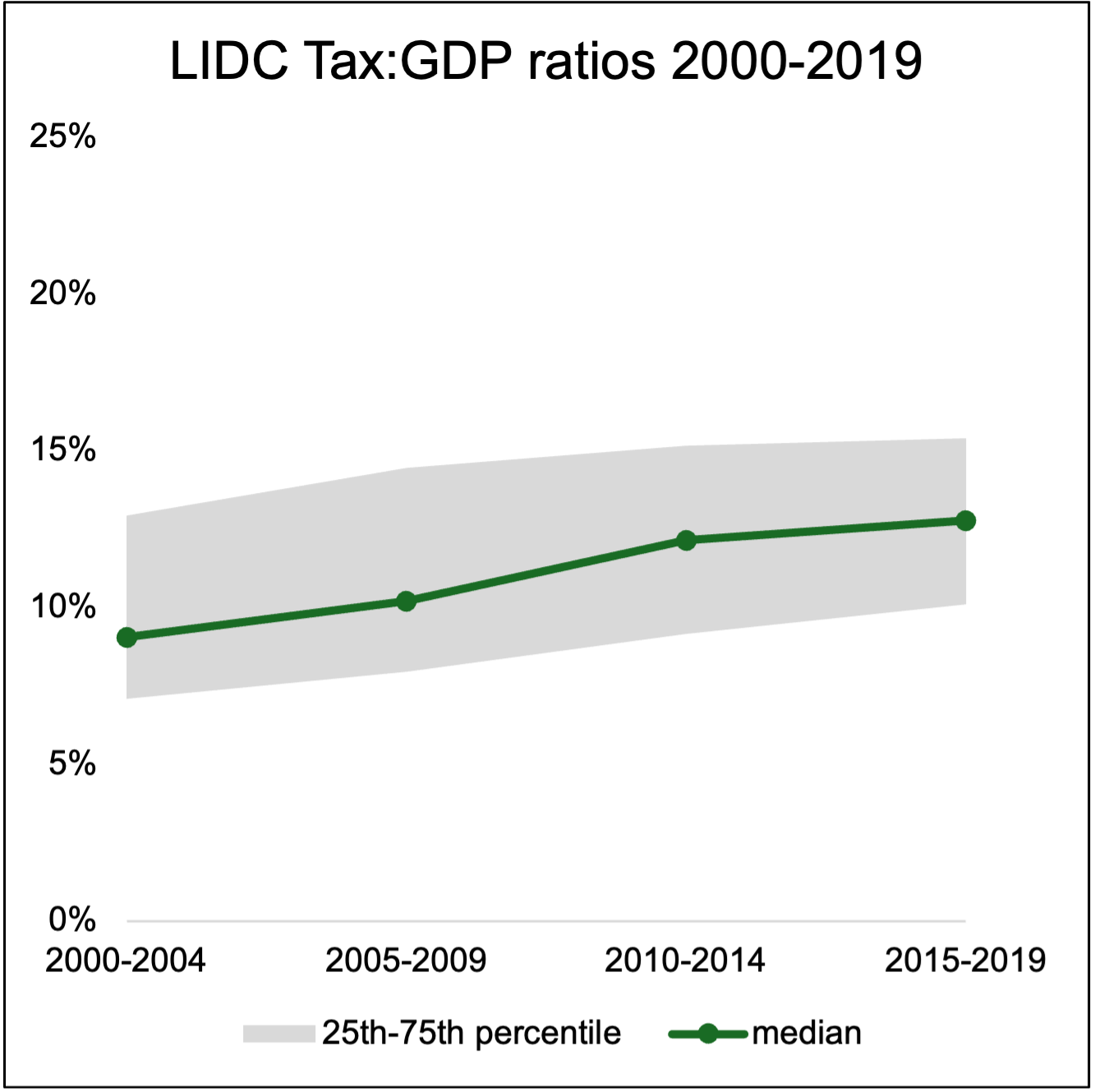

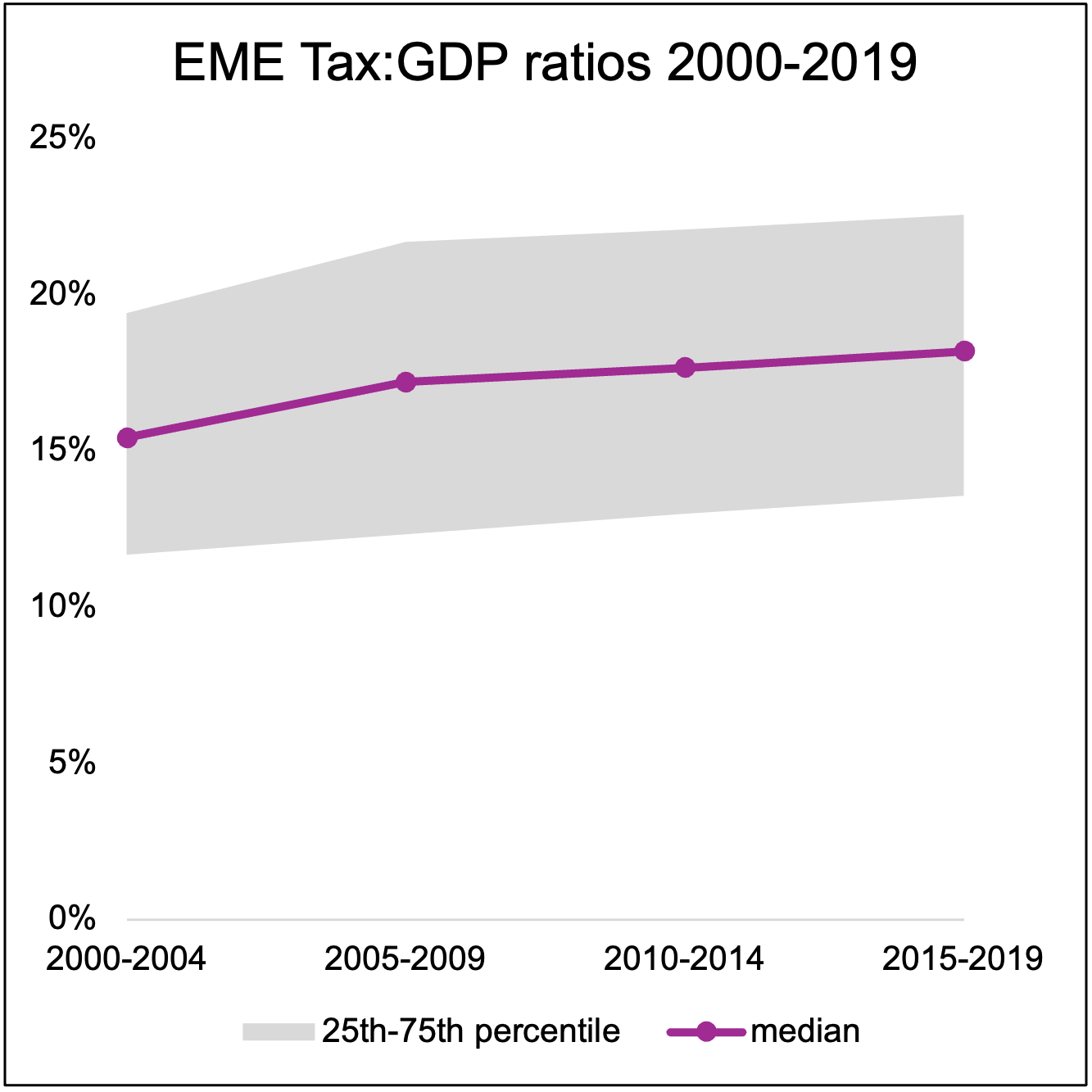

How then, can we set better expectations in terms of progress toward improvements in tax collections in lower income countries? Historical data can provide some clues. A recent brief from the International Centre for Tax and Development (ICTD) shows that almost no low income countries have experienced sustained increases in their tax-to-GDP ratio over the last two decades. It shows that aiming for a sustained annual increase of 0.5ppt in the tax-to-GDP ratio is ambitious. Many emerging market economies (EMEs) and LIDCs are grappling with stalling (or declining) tax-to-GDP ratios that fall well short of their spending needs whilst the average LIDC has seen its tax ratio rise only modestly in the last decade (see Figure below).

While it is essential that governments set tax revenue targets and map out how to meet them, this should be based on detailed and context-specific analysis of the economy and the tax system, encompassing tax administration and policy, and institutions governing tax policymaking. There are inevitable uncertainties, and the impact of reforms may take some years to translate into discernible increases in the tax-to-GDP ratio, not to mention the political feasibility of any reforms that might entail a higher tax burden for certain groups.

Overly ambitious tax targets may put pressure on governments to show results immediately and lead to poor policy and administrative choices. For example, focusing on taxing the ‘informal sector’ to expand the tax net, or devoting significant efforts to collect taxes from lower income individuals or small businesses is unlikely to be the best use of resources by a resource-constrained revenue authority. Policy and administrative reforms that focus on increasing the progressivity of personal income taxes, improving the efficiency of consumption and corporate income taxes, and removing inefficient and regressive subsidies and tax exemptions are likely to yield higher returns in the medium to long run. In any case, context-specific policy appraisals and strategies are crucial.

Beyond these concerns around the realism and accuracy of tax potential estimates, they are also of limited policy use as they do not help diagnose where the exact tax policy or administration inefficiencies might lie in each country, and thus what the reform options to remedy them might be. There are, however, various other diagnostic tools and estimates that are more useful in this regard.

IMF TADAT assessments seek to identify weak points in tax administration and inform a roadmap for improvements; VAT gap analyses can break down VAT performance into compliance and policy gaps that can inform concrete policy solutions; and tax expenditure reports estimate the foregone revenues from these policies.

These kinds of analyses are more useful than ‘tax effort’ and ‘tax potential’ estimates for a policymaker seeking to understand how to improve the design and effectiveness of their tax systems to achieve, among other objectives, a higher tax-to-GDP ratio.

To set – and achieve – more realistic, informed, and meaningful ambitions for tax-to-GDP ratios, long term investments in tax capacity and policymaking capabilities are crucial. Tax capacity can be improved through complementary investments in tax administration and tax policymaking processes, including the use of big data to better understand taxpayer behaviour. Roadmaps such as the medium-term revenue strategy (MTRS) can act as a valuable framework for understanding current challenges in a tax system and mapping out a set of proposed reforms to both policy and administration in line with countries’ objectives over a 3–5-year period.

Improvements to the institutions governing countries’ tax systems are also important, and is one of the key recommendations in the 2023 IMF paper on Building Tax Capacity. The paper provides some practical tips on how to go about this and highlights the key role of building capacity to undertake tax analysis. In many countries, one of the most important institutions involved in tax policy formulation is the tax policy unit, most often seated at the Ministry of Finance. Since 2016, TaxDev – jointly delivered by ODI and the Institute for Fiscal Studies – has been supporting the tax policy units in Ghana, Ethiopia, Uganda and Rwanda to improve the quality of revenue forecasting and reporting, ex-ante and ex-post analysis of policy reform, distributional analysis and tax expenditure reporting. We are also supporting partners on the development and implementation of their MTRS.

Estimating the additional tax revenue a country could feasibly collect as a share of GDP in the medium-term is a complex exercise. Results from studies utilising the ‘tax effort’ methodology provide fairly uncertain estimates and limited information about what specific countries might practically do to improve their tax capacity. Realistic expectations over how much additional tax revenue LIDCs can collect (at least in the short-to-medium-term) lie way below 9ppts of GDP: historical data shows that even annual 0.5ppt increases in tax-to-GDP ratios among LICs are rare.

Yet, estimates by the IMF of the additional spending requirements to meet the SDGs – of which at least some is expected to come from domestic tax revenues – are astronomically high, standing at around 16ppts of GDP per year on average across LIDCs. Coupled with the rising costs of debt service, and the rising spending pressures to mitigate the effects of climate change, it is clear that other financing mechanisms beyond domestic tax revenue – including an expansion of concessional lending and debt relief – are urgently needed. The reality of slow growth, or in some cases stagnation, in tax-to-GDP ratios in LIDCs clearly justifies a focus on increasing the effectiveness of tax policy and administration. But we need to be realistic about the improvements in the tax-to-GDP ratio that these are likely to lead to. Unrealistic expectations of domestic tax revenue cannot be allowed to detract from the urgency of also increasing these other, crucial, channels of financing.

Published on: 17th June 2024

Print